The Smart Managing Your Home Loan EMI Tips & Strategies

Have you ever woken up in the middle of the night stressing about your home loan payments? Trust me, your not alone! After helping hundreds of homeowners navigate their mortgage journeys, I’ve gathered some real-world wisdom I’m excited to share with you today.

Home loans are probably the biggest financial commitment most of us will ever make. The EMIs can stretch for decades, and making smart choices can literally save you lakhs of rupees. Let’s dive into strategies that actually work!

Understanding Your Home Loan EMI: Beyond the Basics

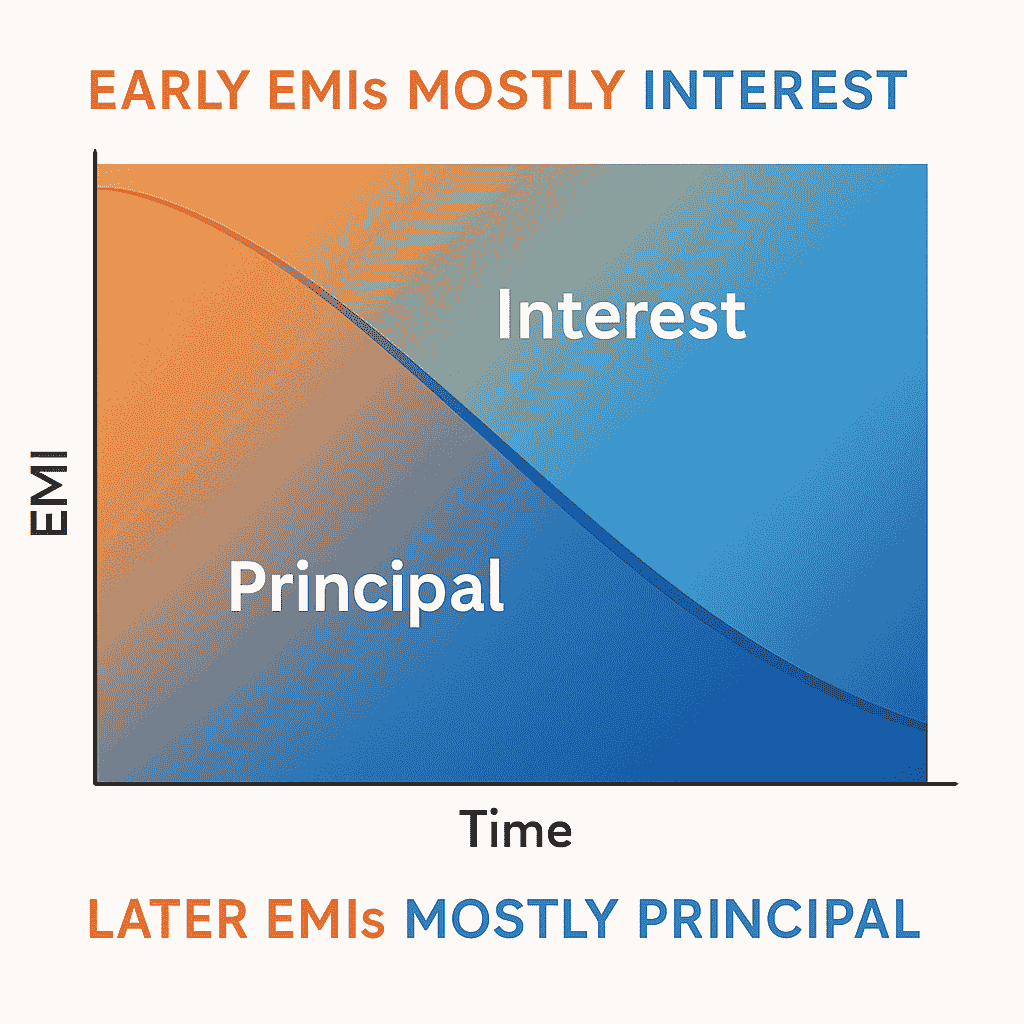

Most people think an EMI is just a monthly bill you have to pay. But it’s so much more than that! Each EMI payment is a carefully calculated amount that includes both principal repayment and interest.

Here’s what makes EMIs intresting – they stay the same throughout your loan tenure (unless you have a floating rate loan), but the proportion of principal vs interest changes dramatically over time.

In the beginning of your loan, upto 80% of your EMI might just be interest! This means your not really making much progress on the actual loan amount initially. Understanding this concept is crucial for developing effective repayment strategies.

When I first saw the amortization table for my own home loan, I was shocked to discover that after 5 years of payments, I’d barely reduced my principal by 15%! That’s when I decided to get serious about optimization.

The Hidden Costs in Your Home Loan

Your interest rate isn’t the only thing that affects the true cost of your home loan. Here are some “hidden” expenses many borrowers overlook:

Processing Fees

Most banks charge between 0.5% to 1% of your loan amount as processing fees. On a 50 lakh loan, that’s ₹25,000 to ₹50,000 right there!

Insurance Premiums

Many lenders require you to purchase loan protection insurance. While useful, these can add significant costs.

Prepayment Penalties

Some loans (especially fixed-rate ones) charge penalties if you try to repay early. These can be as high as 2-3% of the prepaid amount.

[IMAGE: A magnifying glass examining the fine print of a loan document with hidden fees highlighted – use a detective/investigation style]

Documentation Charges

Legal verification, technical evaluation, and documentation all come with fees that add to your total cost.

I remember when my cousin was comparing home loans, he was excited about a “low interest rate” offer until I helped him calculate the effective cost including all fees. Suddenly, it wasn’t such a great deal after all!

7 Proven Strategies to Reduce Your Home Loan Burden

After years of advising homeowners, here are the most effective strategies I’ve seen work time and again:

1. Start With a Larger Down Payment

The math is simple: smaller loan = smaller EMI = less total interest.

If your saving for a home, try to aim for at least 20-25% as down payment. Every extra percent you put down has a compounding benefit over the life of your loan.

When my sister was buying her apartment, she waited an extra 6 months to increase her down payment from 15% to 25%. This reduced her loan tenure by nearly 8 years!

2. Opt for the Shortest Affordable Tenure

It’s tempting to go for the longest tenure to keep EMIs low, but this drastically increases your total interest cost.

[IMAGE: Two path diagrams showing payment journeys – one long path with small steps (low EMI, long tenure) and one shorter path with bigger steps (higher EMI, shorter tenure) – use a journey/path visual metaphor]

Compare these scenarios for a ₹40 lakh loan at 8.5% interest:

- 20-year tenure: EMI = ₹34,836, Total Interest = ₹43.6 lakhs

- 15-year tenure: EMI = ₹39,382, Total Interest = ₹30.9 lakhs

Just by increasing the EMI by ₹4,546 monthly, you save ₹12.7 lakhs in interest!

3. Make Regular Prepayments

This is my favorite strategy! Even small additional payments can dramatically reduce your loan tenure and interest burden.

Try to prepay at least 5% of your outstanding loan amount every year. The earlier in your loan tenure you do this, the greater the impact.

My colleague Ajay made it a habit to use 50% of his annual bonus for loan prepayment. After just 4 years, his 20-year loan was on track to finish in 13 years!

4. Consider Bi-weekly Payments Instead of Monthly

If your lender allows it, making half your EMI payment every two weeks (instead of the full payment monthly) results in 26 half-payments per year – equivalent to 13 months of payments!

This simple change can shorten a 30-year loan by about 4-5 years without significantly affecting your monthly budget.

5. Refinance When Interest Rates Drop

Keep an eye on interest rate trends. Even a 0.5% reduction in interest rate can mean significant savings for large, long-term loans.

[IMAGE: A graph showing interest rate trends over time with a “refinance opportunity zone” highlighted when rates drop significantly – use a line graph with highlighted section]

Just remember to calculate whether the savings will outweigh any refinancing costs!

I helped my uncle refinance his home loan when rates dropped by 1.2% in 2020. Despite the processing fees, he’s saving about ₹4,300 every month for the remaining tenure.

6. Use Windfall Gains Strategically

Received an inheritance, tax refund, or work bonus? Consider using at least a portion to reduce your home loan burden.

Many people use these unexpected gains for vacations or purchases, but directing them toward your largest debt can have a lasting positive impact on your finances.

7. Balance Between Prepayment and Investment

While prepaying your loan saves guaranteed interest costs, sometimes investing that money might yield better returns.

If your home loan interest rate is 7.5% but you can reasonably expect 12-14% returns from equity investments over the long term, it might make mathematical sense to invest rather than prepay.

I personally follow a balanced 50-50 approach – half of my extra funds go to loan prepayment for guaranteed savings, and half go to investments for potential higher returns.

Special Home Loan EMI Situations and Solutions

Let’s talk about some specific situations you might encounter and how to handle them:

When You’re Facing Financial Hardship

If you’re struggling to make payments, don’t just default! Options include:

- Loan restructuring (extending the tenure to reduce EMI)

- Payment holidays (some banks offer temporary relief)

- Balance transfer to a lower rate lender

During the 2020 pandemic, my neighbor was facing income reduction. He approached his bank proactively and got a 6-month EMI moratorium followed by a restructured loan with temporarily reduced EMIs.

For Self-Employed Borrowers

If you have irregular income patterns:

- Consider loans with flexible EMI options

- Maintain a 3-6 month EMI buffer in your account

- Look for loans that allow larger prepayments when business is good

[IMAGE: A self-employed person working at home office desk with calendar showing variable income patterns and EMI planning – use a realistic home office setting]

My friend Ritesh runs a seasonal business. He chose a loan that allowed him to make larger payments during his peak season and just the regular EMI during off-season months.

For Senior Citizens or Near-Retirement Borrowers

If you’re taking a home loan that extends into your retirement years:

- Consider a shorter tenure even if EMIs are higher

- Look into step-down EMI options that reduce after retirement

- Explore joint loans with working children as co-borrowers

My parents took a home loan at age 52 with a careful plan to complete most repayments before retirement. They increased their EMI amount whenever they received pay increases.

Using Technology to Manage Your Home Loan Better

In today’s digital world, there are so many tools to help optimize your home loan experience:

EMI Calculator Apps

Beyond basic calculations, advanced apps can:

- Create multiple scenario comparisons

- Generate prepayment strategies

- Send EMI payment reminders

- Track your loan progress visually

Auto-Payment Systems

Set up standing instructions to ensure you never miss a payment. Some banks even offer interest rate discounts for auto-debit arrangements.

Loan Management Dashboards

Many banks now offer comprehensive dashboards where you can:

- View your outstanding balance in real-time

- Access statements and certificates

- Make online prepayments

- Request tenure modifications

[IMAGE: A smartphone showing a loan management app with graphs, payment options, and account details – use a clean, modern app interface design]

I’ve found that tracking my loan digitally has made me more engaged with it. Seeing the balance decrease month by month is surprisingly motivating!

Tax Benefits on Home Loans: Maximizing Your Advantages

Don’t overlook the significant tax benefits that come with home loans:

Principal Repayment Benefits

Under Section 80C, principal repayment up to ₹1.5 lakhs per financial year can be claimed as a deduction from taxable income.

Interest Payment Benefits

Under Section 24, interest paid on home loans up to ₹2 lakhs annually can be claimed as a deduction for self-occupied property (with higher limits for rented properties).

Additional Benefits for First-Time Homebuyers

An additional deduction of up to ₹50,000 is available under Section 80EE for first-time homebuyers if certain conditions are met.

I make sure to provide all home loan documents to my tax consultant every year. Last year, my total tax savings from home loan deductions amounted to approximately ₹78,000 – that’s like getting more than one EMI back!

Common Home Loan EMI Mistakes to Avoid

After seeing hundreds of borrowers navigate their home loans, here are the most common mistakes I’ve noticed:

Ignoring the FOIR (Fixed Obligation to Income Ratio)

Your total EMIs should ideally not exceed 40-50% of your monthly income. Overextending can lead to financial stress.

Choosing a Lender Based Solely on Interest Rate

Consider service quality, prepayment terms, and hidden charges too. Sometimes a slightly higher rate with better terms is actually cheaper in the long run.

Not Reading the Fine Print

Many borrowers are surprised by charges and conditions they agreed to but never read carefully.

[IMAGE: A person with a magnifying glass reading the fine print of a contract document – use a concerned/focused expression]

Ignoring Insurance Options

Home loan protection plans can safeguard your family from the burden of repayment in case of unfortunate events.

A former colleague passed away unexpectedly at 42, leaving behind a significant home loan. Thankfully, he had opted for loan protection insurance, which cleared the entire outstanding amount, allowing his family to remain in their home without financial stress.

Final Thoughts: Your Home Loan Journey

Remember that your home loan is likely to be with you for many years, perhaps decades. It’s worth investing time to understand it properly and optimize it regularly.

I review my home loan once every six months to check if:

- There are better interest rates available in the market

- I can afford to increase my regular EMI amount

- I should make an additional prepayment

- The tax benefits are being properly claimed

This regular check-in has helped me stay on track to becoming debt-free 7 years ahead of my original loan schedule!

Your home loan doesn’t have to be a burden that weighs you down. With the right knowledge and strategies, it can be a manageable part of your journey to owning your dream home completely.

What strategies have worked well for you in managing your home loan? I’d love to hear your experiences in the comments below!